Home -> News -> Media -> How China’s Near-Defaults Avoided Going Bust

How China’s Near-Defaults Avoided Going Bust

When Shanghai Chaori Solar Energy & Science Technology Co. failed to pay the interest on a bond issued domestically to Chinese investors last month, it was China’s first ever default on such a bond. Or, more accurately, it was the first time investors didn’t get paid.

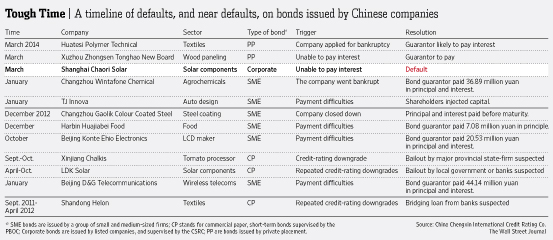

Over the last few years, a number of Chinese companies have defaulted—or at least come close—on their domestic bonds. They’ve either been bailed out, or else the safety nets built into the system by regulators to protect investors have worked like a charm.

Most notably, small firms that have issued bonds as part of a group have been covered by third parties’ guarantees, a way of attracting investors that might otherwise be wary of backing little-known regional firms. When they defaulted, investors still got paid.

The above list from one of China’s biggest credit rating firms doesn’t show things getting worse—in fact, the bond market was more troubled by potential defaults in 2012. But with Chaori’s default having potentially changed the rules of the game, in the future the list might transform from one of last-minute bailouts to actual investor losses.

- .U.S. Treasury looks to hold more cash to deal with future crises

- .Yum, McDonald's in Shanghai food safety investigation

- .Yellen defends loose Fed policy, says job market still too weak

- .Carl Icahn says 'time to be cautious' on U.S. stocks

- .Samsung Electronics says second quarter profit likely down 24.5 percent; worst in two years

- .U.S. jobs data seen reinforcing strong growth outlook

- .Asia stocks up on buoyant Wall Street, oil near highs